Hindenburg Research, the U.S.-based short-selling firm that made headlines in early 2023 with its explosive report on the Adani Group, is once again stirring anticipation. In a cryptic post on Elon Musk’s social media platform X (formerly Twitter), the firm hinted at another significant revelation involving an Indian entity, sparking widespread speculation and concern across financial markets.

The January 2023 Adani Report: A Look Back

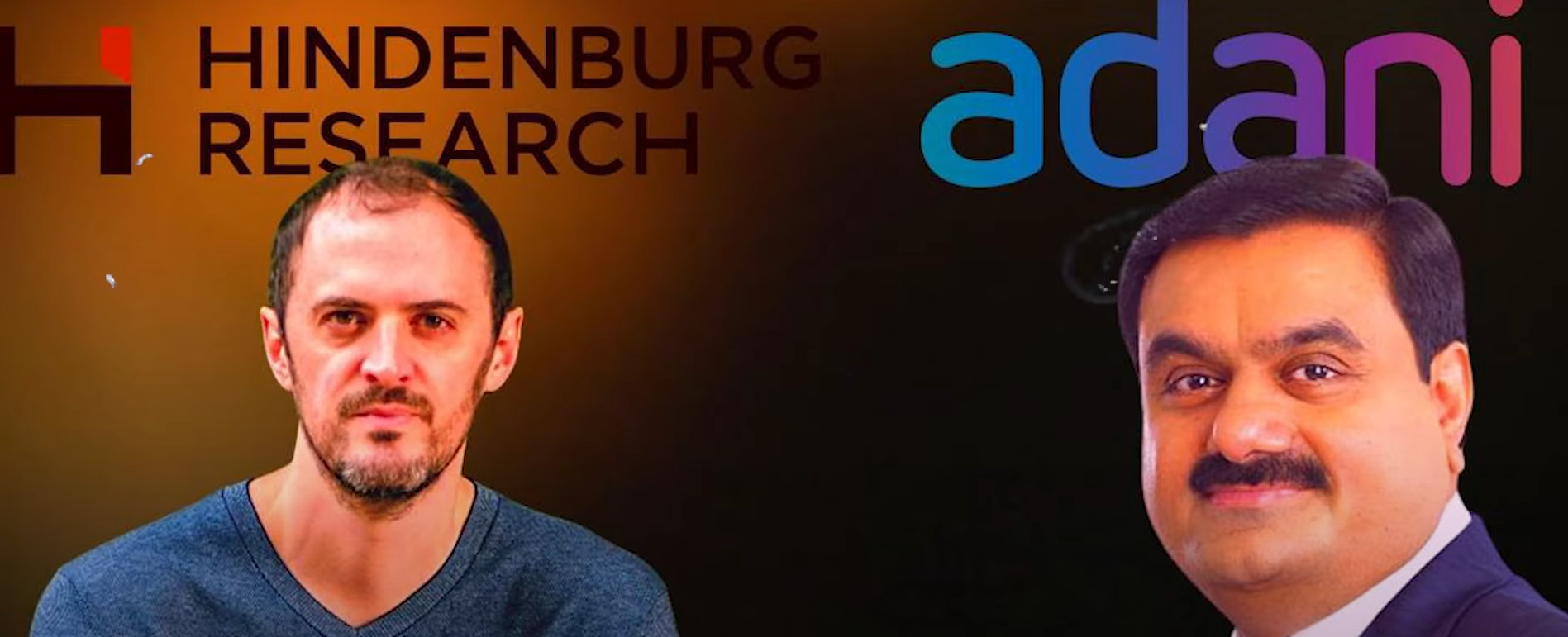

Hindenburg Research is no stranger to controversy. In January 2023, the firm released a damaging report targeting the Adani Group, a conglomerate led by billionaire Gautam Adani. The timing of the report, just before Adani Enterprises’ scheduled share sale, could not have been worse for the group. The fallout was immediate and severe, with the Adani Group’s market capitalization plummeting by an astonishing $86 billion. This sudden drop triggered a massive sell-off of the group’s bonds on international markets and raised serious questions about the financial practices of one of India’s largest conglomerates.

The report accused the Adani Group of engaging in various fraudulent activities, including stock manipulation and accounting irregularities. The allegations sent shockwaves through India’s corporate and financial sectors, leading to heightened scrutiny of the group’s operations both domestically and internationally.

Hindenburg’s Cryptic Message: “Something Big Soon India”

Fast forward to August 2024, and Hindenburg Research is back in the spotlight. On a quiet Saturday morning, the firm posted a simple yet ominous message on X: “Something big soon India.” This brief statement has sent ripples through India’s financial markets, with investors, analysts, and the public speculating on who or what might be the next target of Hindenburg’s investigative research.

Past Actions and Implications for the Future

The Adani report was not the first time Hindenburg had targeted an Indian entity, and it likely won’t be the last. In June 2024, Hindenburg made headlines again when it was revealed that India’s capital market regulator, the Securities and Exchange Board of India (SEBI), had issued a notice accusing the firm of violating Indian regulations. The notice also implicated Kotak Mahindra Bank, one of India’s largest financial institutions, in connection with the report on Adani Group.

Hindenburg strongly refuted SEBI’s allegations, labeling the regulator’s notice as “nonsense” and accusing SEBI of trying to intimidate those who expose corruption and fraud in India. The firm also highlighted the involvement of New York hedge fund manager Mark Kingdon, who allegedly profited significantly by shorting Adani Enterprises’ stock ahead of the report’s release. SEBI’s notice detailed how Kingdon Capital made a $22.25 million profit by establishing short positions in Adani Enterprises before the report’s publication.

The notice also revealed that Kingdon Capital had significant investments in Kotak Mahindra Investments Limited (KMIL), raising concerns about potential conflicts of interest and insider trading. Despite these serious allegations, Kotak Mahindra Bank denied any knowledge of Kingdon’s affiliation with Hindenburg or any involvement in the misuse of sensitive financial information.

What Could Be Next?

Given Hindenburg’s track record and the cryptic nature of its latest message, speculation is rife about which Indian company or industry might be the firm’s next target. The possibilities are vast, and the consequences could be significant, particularly for investors and businesses operating in India’s highly volatile market.

Hindenburg’s previous reports have shown that the firm is not afraid to take on powerful entities, and its investigations often lead to substantial financial repercussions for the companies involved. As such, the mere hint of another major revelation is enough to create uncertainty and tension within India’s financial community.

The Impact on India’s Markets

As anticipation builds, the Indian stock market is likely to experience heightened volatility, with investors closely watching for any signs or leaks that might indicate Hindenburg’s next move. The firm’s previous reports have had a profound impact on market sentiment, leading to sharp declines in stock prices and increased scrutiny from regulators.

For now, all eyes are on Hindenburg Research as the financial world waits to see what “something big” might be. Whether the next revelation involves another major conglomerate, a financial institution, or a different sector altogether, one thing is certain: Hindenburg’s investigations are far from over, and their implications could once again shake the foundations of India’s corporate world.

In the coming days, the mystery surrounding Hindenburg’s cryptic message will likely unfold, revealing whether the firm has another bombshell report in store for India’s financial landscape. Until then, speculation will continue to swirl, and the markets will remain on high alert.